A wake-up call every CFO will recognise

Lisa Chen had five days to present numbers for a $48 million divestiture. She relied on a single EBITDA multiple she’d downloaded from an industry report and shaved only 1 percent for pandemic risk. Three months later the buyer’s advisers re-ran the model and knocked US $15 million off the price. Lisa still calls it “the most expensive copy-and-paste of my career.” Unfortunately, she’s far from alone—98% of business owners don’t know what their company is worth, and 72 percent of CFOs nevertheless expect double-digit growth in 2025

Could your valuation blind spots be equally costly?

Why valuation mastery belongs on your 2025 OKRs

Knowing precisely what the business is worth today—and what will move that number tomorrow—lets you:

- Negotiate mergers or divestitures from a position of strength.

- Raise capital without over-dilution.

- Pinpoint value drivers inside strategic plans.

- Benchmark board targets against hard data.

CFO Insider Tip: Schedule a valuation ‘health check’ before every budgeting cycle rather than waiting for a capital event. – Book a free consultation with Consult EFC.

Valuation fundamentals in 90 seconds

| Pillar | What it means | Quick takeaway |

|---|---|---|

| Standard of Value | Fair Market, Investment, Liquidation | Define the why before the how. |

| Premise of Value | Going concern vs. liquidation | Context changes everything. |

| Level of Value | Control & marketability | Minority discounts can hit 30%+. |

Featured-snippet table: the 5 essential methods

| Method | One-line definition | Best for |

|---|---|---|

| DCF | Discounts future cash flows to present value | Predictable cash generators |

| Market Approach | Applies real-world deal multiples | Industries with active M&A data |

| Asset-Based | Values net assets at FMV | Asset-heavy or liquidation cases |

| Revenue Multiple | Applies industry x-times revenue | Early-stage / SaaS benchmarks |

| Earnings Multiple | Multiplies profits (P/E or EBITDA) | Mature, profitable firms |

1. Discounted Cash Flow (DCF)

Real-world snapshot: Maria González, CFO of a $120 million manufacturer, modelled nine scenarios and discovered that leasing robotics instead of buying lifted enterprise value 18 percent.

CFO Insider Tip: Back-solve your discount rate from current BBB bond yields plus a bespoke risk premium instead of defaulting to 10%.

2. Market Approach (Comparable Analysis)

Think “Kelley Blue Book” for businesses.

| Common multiples | Current median* |

|---|---|

| EV/Revenue | 2.4× |

| EV/EBITDA | 9.7× |

*Source: Prof. Aswath Damodaran datasets

War-story box: A mis-categorised “comparable” with 8% EBITDA margin skewed an industrial client’s valuation by 23%. Double-check SIC codes and margin profiles before you hit calc.

3. Asset-Based Valuation

When assets—not cash flow—drive value, compute Net Asset Value = Assets − Liabilities. See Liquidation Value standards

During a distressed sale of a Midwest foundry, scrap metal proceeds alone covered 78 percent of lender exposure—a fact only revealed after an adjusted-FMV asset review.

4. Revenue Multiple Method

Quick and dirty—but only if churn is low.

| Sector | Typical multiple |

|---|---|

| SaaS | 3-5× (link to Bessemer SaaS benchmarks) |

| Professional services | 0.8-2× |

| Manufacturing | 1-3× |

CFO Insider Tip: If net-revenue retention <90%, halve the headline SaaS multiple before negotiations.

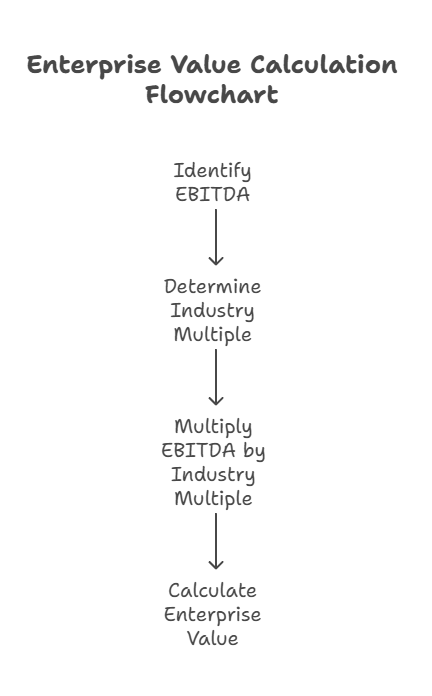

5. Earnings Multiple (P/E or EBITDA)

Did you know that switching from GAAP net income to adjusted EBITDA shaved 800 bps off one client’s P/E-based value – but won credibility with private-equity buyers.

Choosing the right blend

| Business stage | Primary method | Supporting method |

|---|---|---|

| Startup | Revenue multiple | Asset-based |

| Growth | DCF | Market comps |

| Mature | Market comps | DCF |

| Decline | Asset-based | Liquidation value |

Weight the primary at ~65% and triangulate the rest.

Five valuation mistakes that cost millions

- Using a single method – inflates errors exponentially.

- Ignoring live market conditions – 2025 interest-rate swings can move WACC 150 bps overnight.

- Messy financials – normalise and strip one-offs first.

- Forgetting intangibles – IP and brand often dwarf PP&E.

- Terminal value mis-calc – see Corporate Finance Institute guide.

Ready to Unlock Your Company’s True Value?

Don’t let valuation blind spots cost you millions like Lisa’s $15 million mistake. Most CFOs discover they’ve been undervaluing their business by 20-40% when they finally get a professional assessment.

Take the first step toward strategic value creation:

🎯 Get Your Business Valuation Assessment

What you’ll receive:

- 30-minute valuation health check using the methods from this guide

- Custom benchmarking against industry peers in your sector

- 3 immediate value optimisation opportunities specific to your business

- Strategic roadmap for the next 12 months to maximise enterprise value

No generic templates. No sales pressure. Just actionable insights from certified ICAEW Chartered Accountants who understand the CFO mindset. Contact us today.