You’re in the pitch meeting. The slides are perfect, your vision is compelling, and the investors are nodding along. You feel the momentum building. Then comes the inevitable, quiet request: “This all looks very promising. Could you send over the financial model?”

For a founder, this is the moment of truth.

This is where many otherwise brilliant pitches begin to unravel. A poorly constructed financial model does more than just present questionable numbers; it sends a clear signal to savvy investors that you may lack the strategic depth, financial discipline, or operational grip required to run the business effectively. It undermines your credibility at the final hurdle.

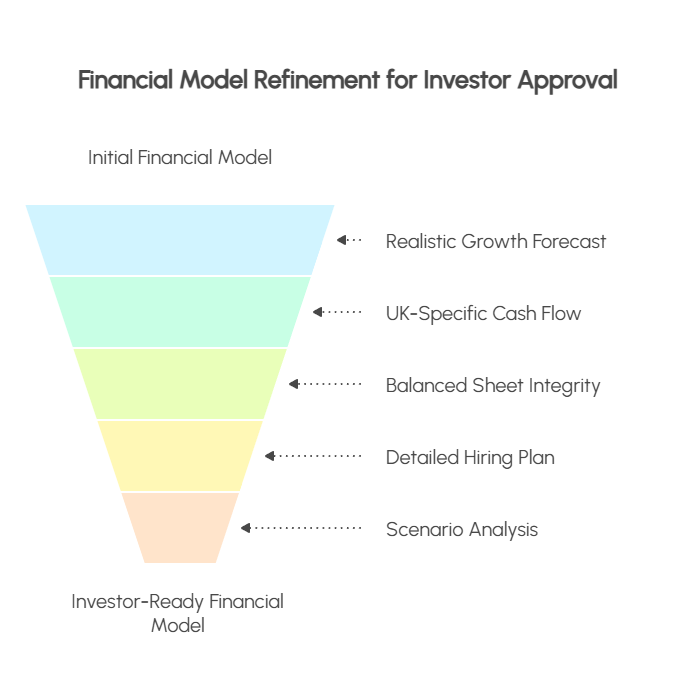

As advisors who work with UK businesses preparing for funding, we see the same “deal-killer” mistakes time and again. Here are the five most common—and how you can avoid them.

Mistake #1: The Unrealistic “Hockey Stick”

The Problem: The model shows slow growth for the first two months, followed by an explosive, near-vertical “hockey stick” curve that reaches millions in revenue by year two.

Why It’s a Red Flag: Every investor has seen a thousand of these. It immediately suggests your plan is based on hope, not strategy. It shows a fundamental misunderstanding of the time, effort, and capital required to acquire customers, build a brand, and scale operations.

The Solution: Build your forecast from the “bottom-up.” Instead of plugging in a high-level growth rate (e.g., “20% month-on-month”), base your revenue on tangible, defensible drivers. For example:

(Monthly Marketing Spend ÷ Cost Per Lead) x Lead-to-Customer Conversion Rate = New Customers Per Month.

This approach forces you to justify every assumption and demonstrates to investors that you understand the mechanics of your own growth engine.

Mistake #2: Ignoring UK-Specific Cash Flow Killers

The Problem: The model looks great from a Profit & Loss perspective, but it completely ignores the real-world cash impact of UK taxes, specifically VAT and Corporation Tax.

Why It’s a Red Flag: This is a classic rookie error that signals you are not ready to operate a business in the UK. Profit is not cash. An investor knows that a profitable business can—and often does—go bankrupt because it can’t pay its VAT bill to HMRC on time.

The Solution: Model VAT on a cash basis. Your P&L revenue should be net of VAT, but your cash flow statement must show the full cash amount coming in from customers and the quarterly cash payment going out to HMRC. Likewise, Corporation Tax must be accrued for as a liability and its payment planned for in your cash flow forecast. Getting this right is a huge green flag for operational readiness.

Mistake #3: The Balance Sheet Doesn’t Balance

The Problem: At the bottom of your Balance Sheet, Total Assets do not equal Total Liabilities + Equity.

Why It’s a Red Flag: This is a fatal technical error. It is the financial modelling equivalent of a glaring typo in the headline of your CV. If this fundamental accounting equation doesn’t hold true, an investor will assume the entire model is riddled with errors and cannot be trusted. It instantly destroys all credibility.

The Solution: Always include a “Balance Check” line at the bottom of your Balance Sheet that subtracts one side from the other. This cell must show zero (or a negligible rounding error) for every single month in your forecast. No exceptions. It is a non-negotiable test of your model’s integrity.

Mistake #4: A Vague or Non-Existent Hiring Plan

The Problem: Staff costs are represented as a single, aggregated line item that grows vaguely over time.

Why It’s a Red Flag: For most startups, headcount is the single largest expense. A lack of detail here tells an investor you haven’t thought strategically about the most critical use of their capital. Who exactly are you hiring? When do they need to start? What is their fully-loaded cost, including National Insurance and pension contributions?

The Solution: Create a detailed, role-by-role hiring plan on a separate tab. It should list the job title, proposed start date, base salary, and calculations for employer’s NI and pension costs. This plan should be logically tied to your growth milestones—for example, hiring a new salesperson for every 50 new customers acquired.

Mistake #5: Presenting a Single, Perfect Scenario

The Problem: The model shows only one version of the future—the one where everything goes exactly to plan.

Why It’s a Red Flag: It signals naivety. No business plan survives first contact with reality, and experienced investors know this better than anyone. They are not investing in your plan; they are investing in your ability to adapt when that plan breaks.

The Solution: Build in scenario analysis. Your model should have an input cell that allows you (and the investor) to easily switch between a Base Case, a Best Case (e.g., lower churn, higher conversion), and a Worst Case (e.g., delayed product launch, higher CAC). This demonstrates strategic foresight and proves you have already stress-tested the business and have contingency plans in mind.

Don’t Let a Spreadsheet Sink Your Vision

Your financial model is the bridge between your compelling vision and the financial reality of your business. Getting it right is your opportunity to prove you have the commercial acumen and operational discipline to be a responsible steward of an investor’s capital.

Don’t let these preventable errors undermine your hard work.

If you want to walk into your next pitch meeting with a financial model that withstands scrutiny and inspires confidence, schedule a complimentary discovery session with our advisory team today.